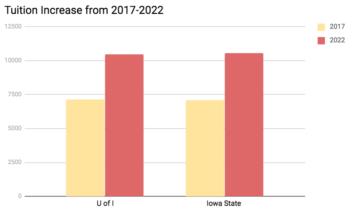

Graph showing change in tuition prices from 2017 to 2022 in dollar amounts

Iowa’s two largest public colleges Iowa and Iowa State plan to raise in-state tuition 7 percent yearly for five years.

This percent is added on to the tuition each year so instead of it just being an increase of 35 percent in five years it will actually be up to 41 percent by the year 2022. Iowa State’s tuition will be $10,457 by the fall of 2022 and Iowa’s will be $10,537. That is a rise from $7,098 and $7,128 from the 2017 school year respectively. These tuition increases are to keep up with the growth rates of the colleges and with inflation.

DMACC President Robert Denson said there are many factors that lead to tuition increases.

“I know that our state univer

sities are as reluctant to increase tuition and fees as we are at DMACC. We know that any increases impact our students, and often results in increased student debt. Each year the DMACC Board of Directors reviews the increased costs DMACC faces, enrollment projections, our legislative appropriation, and then determines a rate that balances our budget. Our increases are generally in the 2.5-3.0 percent range,” Denson said.

University of Northern Iowa has a different plan; raise tuition by a decreasing percent each year. This year tuition for UNI was up 5 percent; next year, they want a 4 percent raise and then eventually lower that to an increase of 1.75 percent by 2022.

This plan all depends on if lawmakers decide to give the school money based on inflation or not. If they don’t, UNI’s plan most likely will not work, as they won’t have enough money for everything in their budget.

Kyle Strothcamp, an accounting major at DMACC, plans to transfer to Iowa State in January.

“I am more than willing to pay for my education. You cannot put a price on your education. I am willing to take out student loans, and I am not concerned with the student loan debt because I was paying near 3 percent interest the last time I took out loans, and I can make much better interest rates on other investments,” Strothcamp said.

Strothcamp also stated, “If the students want to get the quality education that they need with the necessary resources, they will happily pay the tuition.”

Simpson, a private college in Indianola, Io

wa is offering free tuition to students to help counter the price of college.

There are a few caveats to this; tuition is free for student’s graduating high school in 2018 if their families make an adjusted gross income of $60,000 or less.

They must also live on campus and pay room and board fees which would cost an upwards of $9,000.

In-State tuition costs for Simpson are a little over $34,000 a year, but keep in mind all first-year students get at least $20,000 in grants. This drops the cost of tuition to about $14,000.

For many students, choosing a private college is a cheaper option, as private colleges offer grants to combat the high cost of tuition. According to the Drake website, 98 percent of their full

-time undergraduate students receive scholarships provided by the University.

First-year Simpson students all get at least $20,000 grants. Transfer students can also get large scholarships.

These scholarships depend on GPA, for example if a transfer student has a 2.5-2.99 GPA, they receive $17,500 and it goes up from there. The largest scholarships go to those who are part of the honor society ($23,000).

Tuition has been rising for many reasons besides i

nflation but salaries have not been rising in line with that inflation. In Iowa, the wage needed to be able to pay rent, buy food and deal with other living expenses is a little over $10 per hour for a 40-hour workweek while our minimum wage is $7.25 per hour. This may make paying for college difficult for many students and make tuition a main factor in college choice.

Comments